Merchant Banker Functions

They help small business to raise finance either through bridge financing or mezzanine financing. Underwriting of initial public offering of shares and debentures Appraising promoting and financing domestic or overseas projects by raising resources in the form of equity debenture and long-term loans.

Top 12 Functions Performed By Merchant Bankers

The merchant bankers are individuals or entity who help in channelling of funds from the market participants who have surplus funds to individuals who need finance for their business.

Merchant banker functions. Recommended Articles This is a guide to Merchant Bank. Some of them even maintain venture capital funds to assist the entrepreneurs. Functions of Merchant Banking Organization Portfolio Management.

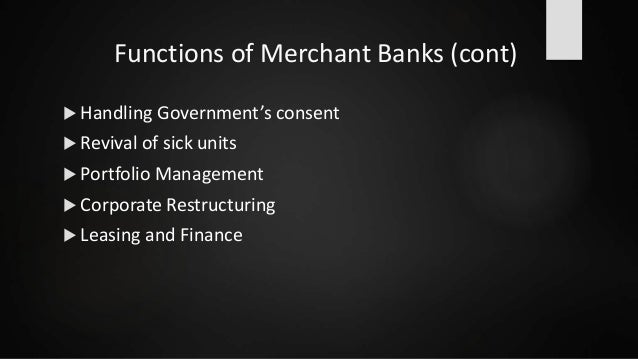

A merchant banker performs many functions. Functions Of Merchant Banks cont Leasing and Finance Many merchant bankers provide leasing and finance facilities. They are also responsible for preparing the prospectus and marketing the issue.

Then another functions of merchant banker is acting as intermediary between savers and investors such as collecting application issuing the shares etc. They trade in securities on behalf of the clients with the aim of providing. With a merchant banker a businessman enjoys the benefit of hiring a skilled and knowledgeable partner with a long-term commitment to the business.

The real benefit here is that a merchant bank helps to lower the risks for a new firm. Acting as Issuing Houses in the Capital Market. Second they have expanded the use of risk-based pricing from.

He assists the companies in raising funds from the market. Handling government consent for industrial projects. They help in managing Euro-issues and raising funds abroad.

Functions of Merchant Banks. Merchant banks are engaged in issuing or floating of new securities for private and public companies and for government state and local seeking to raise long-term or permanent finance for their projects. Functions of the Merchant Bank.

In the past the function of a merchant banker had been mainly confined to the management of. For all services involved in the performance of this function merchant banks receive a. Merchant banks work domestically and internationally to help clients raise funds through investors loans and other funding sources.

A merchant banker provides specialized services in the stages of preparation of a project the loan applications required for the raising of short-term and long- term credit from various banks and financials institutions etc. Some of the functions of merchant banking include. Merging banking investment and insurance functions allows traditional banks to respond to increasing consumer demands for one-stop shopping by enabling cross-selling of products which the banks hope will also increase profitability.

Collecting application from an investor Keeping a proper record Money receiving Money repaying. Merchant bankers are in charge of the issue process. Merchant bankers provide advice to entrepreneurs right from the stage of conception of the project till the commencement of production.

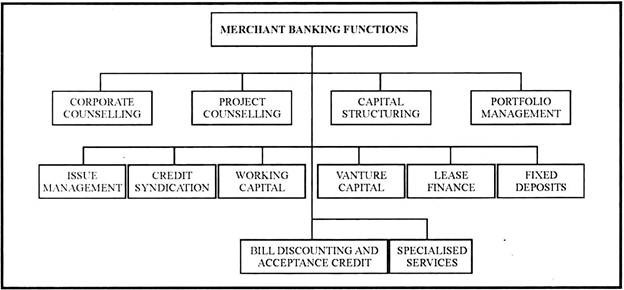

What is a Merchant bank. Issue management portfolio management credit syndication acceptance credit counsel on mergers and acquisitions insurance etc. Provide guidance in diversification.

Extending assistance for and. Merchant banks provides advisory services to the institutional investors on account of investment decisions. They act as intermediaries between the company and the investors.

Merchant banks handle projects for clients by conducting feasibility studies designing funding plans and offering legal financial advice. Merchant Bank is a company that provides services like fundraising activities like IPOs FPOs loans underwriting financial advising or market making for big companies and individuals having huge net worth but they do not provide for the basic banking services such as checking accounts etc. Registration The registrar an issue as an intermediary in the primary market carry activities of.

Functions of Merchant Banks. Known as accepting and issuing houses in the UK and investment banks in the US modern merchant banks offer a wide range of activities. A merchant bank functions as a promoter of industrial enterprises in India He helps the.

They also help companies in raising finance by way of public deposits. Merchants started to store their gold with the goldsmiths of London. The undergoing tasks include instrument designing pricing the issue registration of the offer document underwriting support marketing of the issue allotment and refund and listing on stock exchanges.

Some of the important functions undertaken by a merchant banker are as follows. This forms the main function of the merchant banker.

List Of Banks In India Public Sector Banks Bbalectures Bank Of India Business Articles Banking

Functions Of Investment Banker A Financial Intermediary Investing Investment Banking Raising Capital

Posting Komentar untuk "Merchant Banker Functions"