A Merchandising Company Has Different Types Of Adjusting Entries Than A Service Company

Correct answer - a merchandising company has different types of adjusting entries than a service company true or false. A merchandising company generally has the same types of adjusting entries as a service com-pany but a merchandiser using a perpetual inventory system will require an additional adjustment to reflect the difference between a physical count of the inventory and the accounting records.

Chapter 5 Merchandising Operations Ppt Download

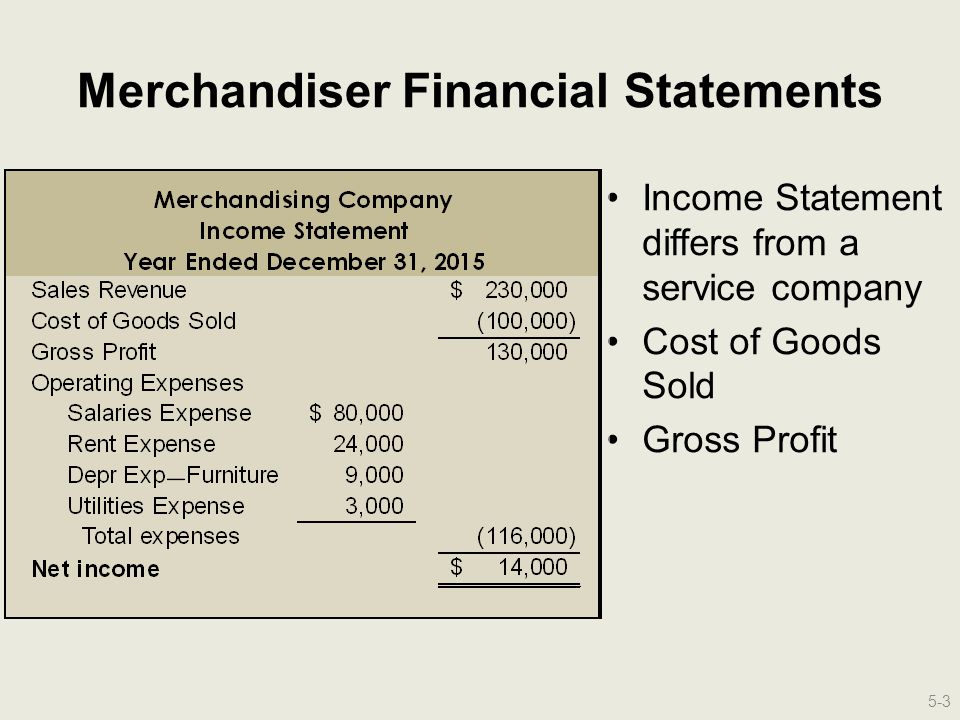

Sales minus operating expenses equals gross profit.

A merchandising company has different types of adjusting entries than a service company. Name Email Save my. 1 Whether it is a merchandising company or service company. The steps in the accounting cycle are different for a merchandising company than for a service company.

For a merchandising company all accounts that affect the determination of income are closed to the Income Summary account. TF Operating expenses are different for merchandising and service enterprises. A merchandising company has different types of adjusting entries than a service company.

A service company provides intangible services to customers and does not have inventory. Leave a Reply Cancel reply. Nonoperating activities exclude revenues and expenses that result from secondary or auxiliary operations.

Purchasing merchandise paying for merchandise storing inventory selling merchandise and collecting customer payments. 3 question T or f a merchandising company has different types of adjusting entries than a service company. A merchandising company has different types of adjusting entries than.

A merchandising company has different types of adjusting entries than a service company. A merchandising company has different types of adjusting entries than a service company true or false. Merchandising companies have financial transactions that include.

Freight terms of FOB. Nonoperating activities exclude revenues and expenses that result from secondary or auxiliary operations. The Answer is E All of the Statements are correct.

Some examples of service companies include. View the full answer. But a merchandiser will have one additional adjustment to make the records agree with the actual inventory on hand.

TF A merchandising company has different types of adjusting entries than a service company. A merchandising company has different types of adjusting entries than a service company true or false. The perpetual inventory records may be incorrect due to a variety of causes such as recording errors theft or waste.

In addition like a service company a merchandising company closes all. Selling expenses relate to. Which of the following statements is correct regarding the adjusting entries for a merchandiser versus a servic A service company will have an adjusting entry.

Required fields are marked Comment. Generally adjusting journal entries are made for accruals and deferrals as well as estimates. Before we look at recording and posting the most common types of adjusting entries we briefly discuss the various types of adjusting entries.

A merchandising company generally has the same types of adjusting entries as a from ACC MISC at Northwest Iowa Community College. False Nonoperating activities exclude revenues and expenses that. A merchandising company has different types of adjusting entries than a service company true or false.

Your email address will not be published. A merchandising company has different types of adjusting entries than a service company true or false. A merchandising company has different types of adjusting entries than a service company.

Selling expenses relate to general operating activities such as personnel management. A merchandising company generally has the same types of adjusting entries as a service company but a merchandiser using a perpetual inventory system will require an additional adjustment to reflect the difference between a physical count of the inventory and the accounting records. It is a result of accrual accounting.

And follows the matching and revenue recognition principles. The required adjusting entries depend on what types of transactions the company has but there are some common types of adjusting entries. A merchandising company has different types of adjusting entries than a service company.

A merchandiser has the same adjusting entries as a service company. In addition like a service company a merchandising company closes all accounts that. Under a perpetual inventory system the cost of goods sold is determined each time a sale occurs.

An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred. TF Net sales appears on both the multiple-step and the single-step forms of. A typical operating cycle for a merchandising company starts with having cash available purchasing inventory selling the merchandise to customers and finally collecting.

A periodic inventory system requires a detailed inventory record of inventory items. TF a merchandising company has different types of adjusting entries than a service company False TF Non operating activities exclude revenues and expenses that result from secondary or auxiliary operations. TF Non-operating activities exclude revenues and expenses that result from secondary or auxiliary operations.

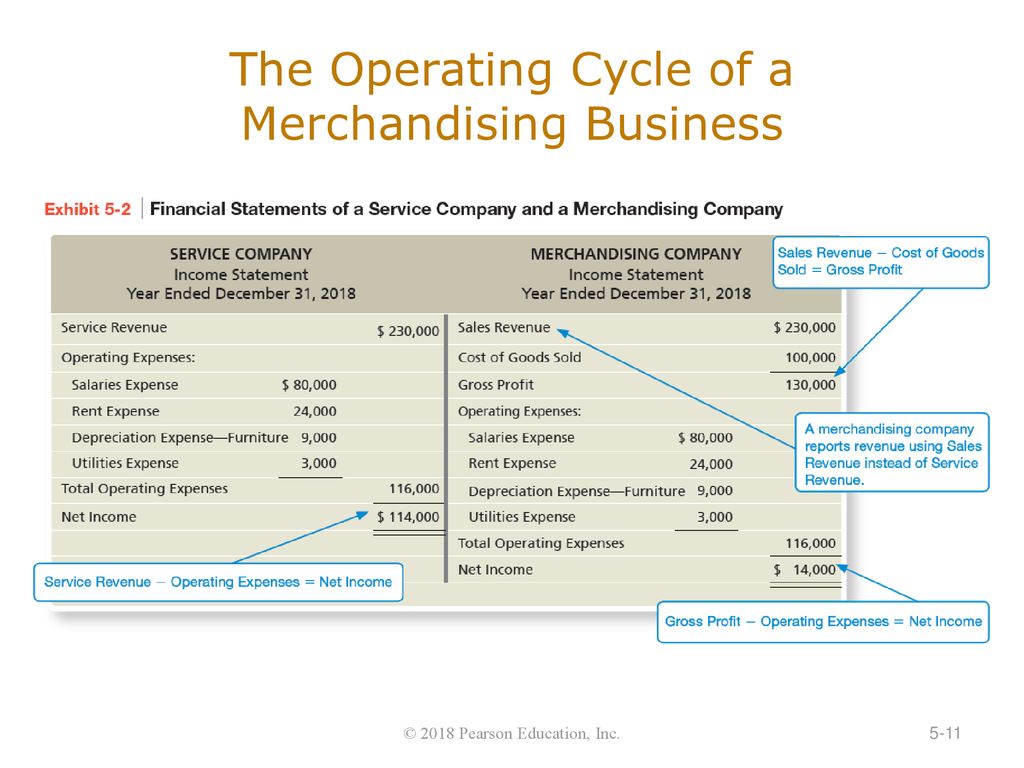

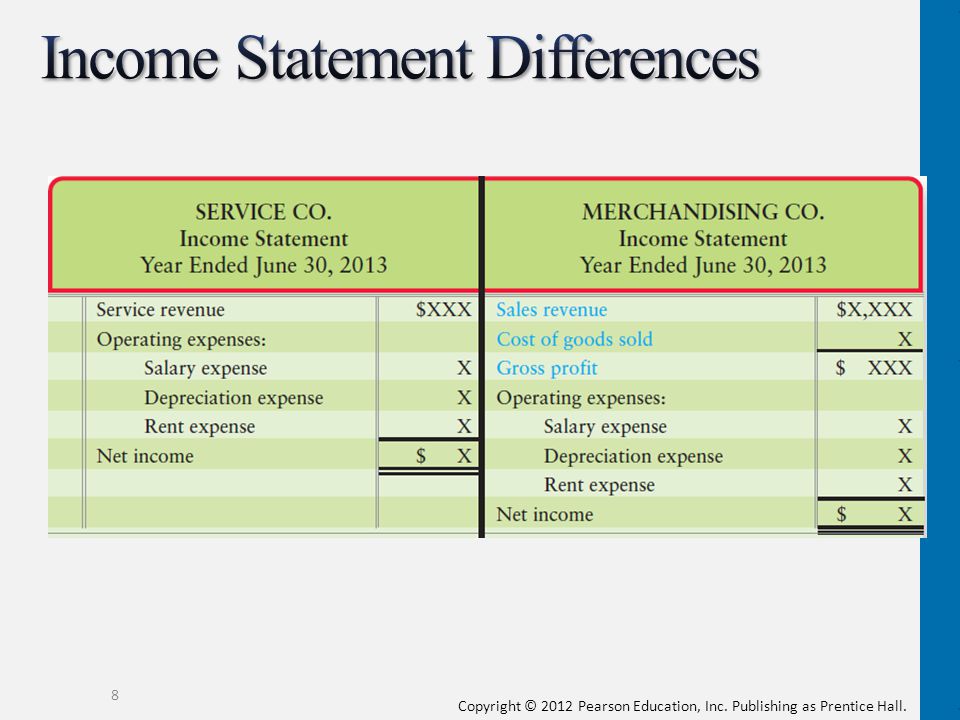

Some of the biggest differences between a service company and a merchandising company are what they sell their typical financial transactions their operating cycles and how these translate to financial statements.

Merchandising Operations Ppt Video Online Download

Chapter 5 Full Text Explanation And Questions And Answers Studocu

Merchandising Operations Ppt Download

Posting Komentar untuk "A Merchandising Company Has Different Types Of Adjusting Entries Than A Service Company"