A Merchandising Business That Usually Has No Beginning Inventory Is When It Has Just Started

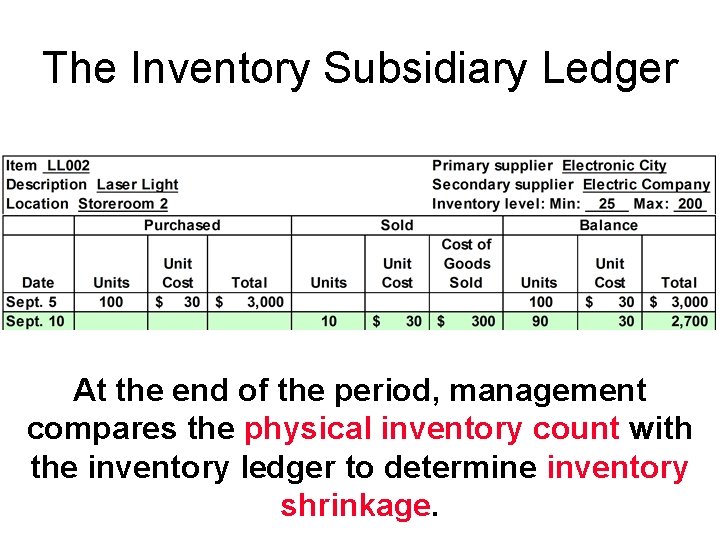

Difference is called inventory shrinkage. Merchandise Inventory at the beginning of the year 3600.

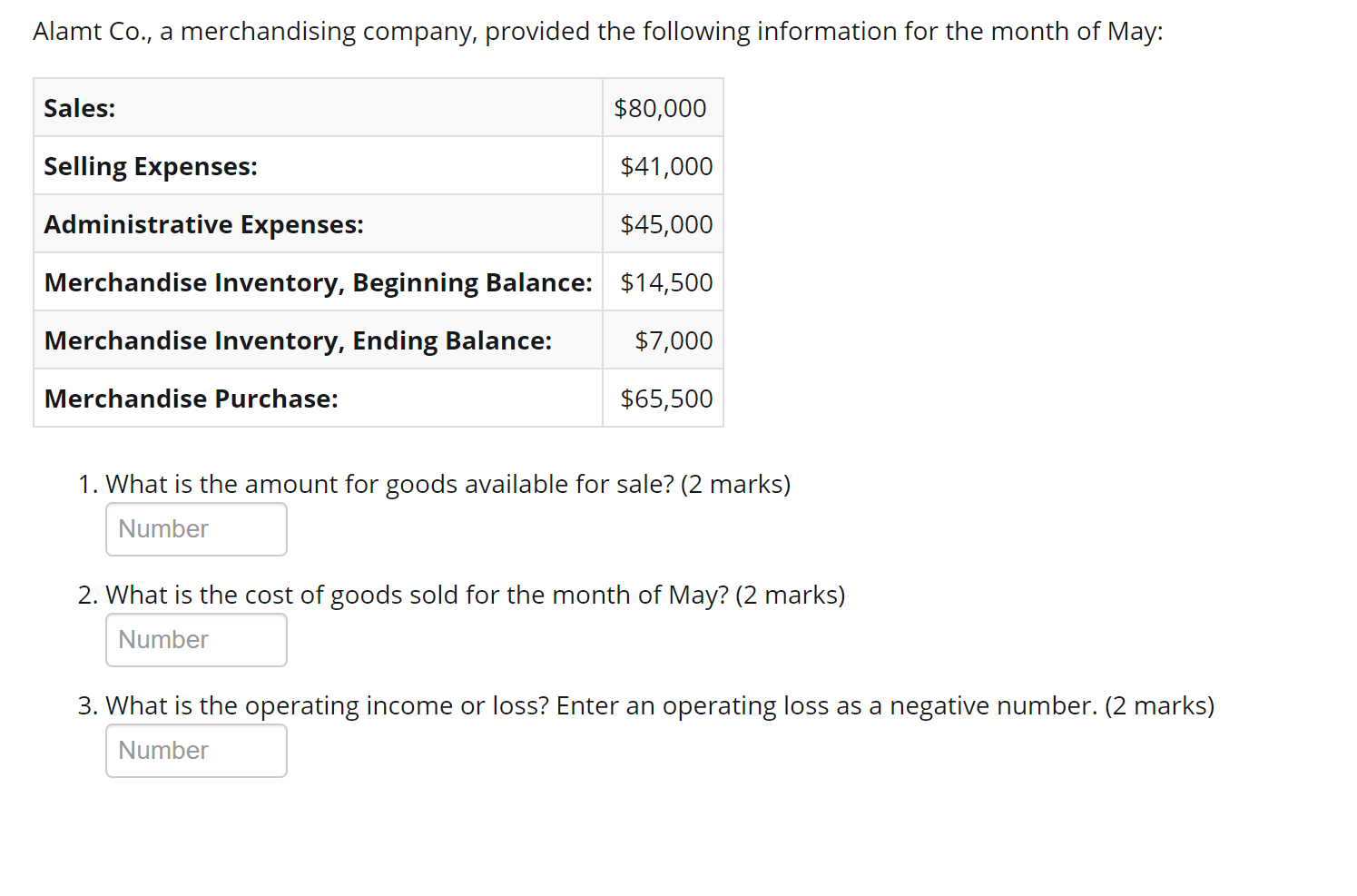

Solved Alamt Co A Merchandising Company Provided The Chegg Com

A 87120 B 75240 C 88000 D 76000.

A merchandising business that usually has no beginning inventory is when it has just started. Because sales growth was strong during 2018 the owner wants to increase inventory on hand to 450000 at December 31 2018. Accordingly on the merchandising income statemen t under the periodic inventory system only. When adjusting entries are used two separate entries are made.

Sales Returns and Allowancesthe same entry made under the perpetual system. Has a cost of goods sold of 5M for the current year. Finished goods possessed for sale by manufactures are usually called finished goods inventory.

TF If a company has no beginning inventory and the unit price of inventory is increasing during a period the cost of goods available for sale during the period will be the sale under the LIFE and FIFO inventory methods. Add purchases to the beginning inventory which is the prior periods ending inventory to get the goods available from sale. Goods available for sale is the maximum value of goods that could be sold.

Beginning Merchandise Inventory was 820000. If there is inventory remaining. Businesses that only offer services.

Another name for merchandise inventory is stock-in-trade stock for short. When is usually a merchandising company doesnt have a Beginning Inventory. The cost of merchandise purchased is equal to a.

Since accounting is the same for merchandise inventory and finished goods inventory the. When an invoice is paid within the discount period the amount of the discount is credited to. Inventory Turnover Ratio Cost of Goods SoldAverage Inventory For example.

Salesthere is just one entry to record the sale. Highlighting supply chain issues. If net sales for 2018 are expected to be 2600000 and the gross profit rate is expected to be 35 compute the cost of the merchandise the owner should expect to purchase during 2018.

Any change to beginning inventory compared with the previous period usually signals a shift in the business. If you have little-to-no beginning inventory it could indicate that you possibly over-ordered inventory during the previous period. Garden Company returned 12000 of the merchandise and received full credit from Parker Company.

The first adjusting entry clears the inventory accounts beginning balance by debiting income summary and crediting inventory for an amount equal to the beginning. Given the inventory balances the average cost of inventory during the year is calculated at 500000. This gives us goods available for sale.

At the beginning of 2018 Wilson Stores has an inventory of 300000. Subtract the ending merchandise inventory to get the cost of goods sold. Sales is a revenue account with a normal credit balance.

Recording Sales of Merchandise. In a periodic system purchases of new merchandise inventory and sales are tracked in the purchases and sales accounts respectively. Purchases Returns and Allowances 1950.

The merchandise inventory of a drugstore is the goods for sale on the store shelves and in the storeroom. The goods available for sale that are not on hand have been sold lost broken or stolen. Beginning inventory provides insight into the valuation of your stock which is useful for internal accounting documents such as income statements.

Under the periodic inventory system is NO second entry to record the cost of goods sold. - 8097807 alanmario704 alanmario704 04122020 Math Elementary School answered 3. Merchandise inventory is finished goods acquired for sale by retail or wholesale traders.

Increased beginning inventory could be due to a business ramping up. The differentiating factor is what it offers - whether it provides finished products to consumers or services. The inventory accounts balance may be updated with adjusting entries or as part of the closing entry process.

Actual inventory on hand at end of accounting period is usually less than balance of Merchandise Inventory. For instance decreasing beginning inventory could be a result of growing sales during the period or it could be due to an issue in the supply chain or inventory management process. A retailer is a company that buys products from manufacturers and sells them to wholesalers.

If payment is not made within 10 days then there is no purchase discount and the net amount of the bill is due within 30 days. Ending Merchandise Inventory was 1027900. Most businesses can be classified into one or more of these three categories.

A company performs a service sells inventory that it purchases from others or manufacturers a product. Similarly having more or less stock than usual could be due to an issue in the supply chain. If Garden Company pays within the discount period what is the amount of cash required for payment.

The companys cost of beginning inventory was 600000 and the cost of ending inventory was 400000. Under a periodic system we add beginning inventory to the cost of purchases. Retailers normally experience some loss of inventory due to shoplifting employee theft or errors.

For example if the. Garden Company purchased merchandise on account from Parker Company for 88000 with terms 115 net 45. When is usually a merchandising company doesnt have a Beginning Inventory.

Inventory is often the largest asset an ecommerce business has and beginning inventory is the amount documented when a new accounting period starts. It cannot serve more than one of these functions. If we sold every unit we had on hand and had no inventory left at the end of the year goods available for sale would equal cost of goods sold.

A company using the periodic inventory system has the following account balances. Definition Formula Examples Journal Entry. Note there is NO second entry to record the return of the Merchandise.

If a purchase discount has terms 310 n30 then a 3 discount is taken on the invoice price less any returns or allowances if payment is made within 10 days. Manufacturing merchandising or serviceStated in broad terms manufacturing firms typically produce a product that is then sold to a merchandising entity a retailer For example Proctor and Gamble produces a variety of shampoos that it sells to retailers such as Walmart Target or Walgreens. 1 See answer tRiCiA3s29.

Cost of Goods Sold section Beginning Inventory inventory on hand at start of period -. The PERIODIC system is being used less and less due to advancements in technology that make the extra record keeping of the. It helps with ecommerce.

Merchandise inventory is listed as a current asset on the balance sheet. Balance of the merchandise inventory account is amount of merchandise available for sale at that point in time. Inventory Purchases were 1316900.

Periodic Inventory Systems Because entries are not made to the inventory account during the accounting period the amount of inventory is not known until the end of the period when the inventory count is done.

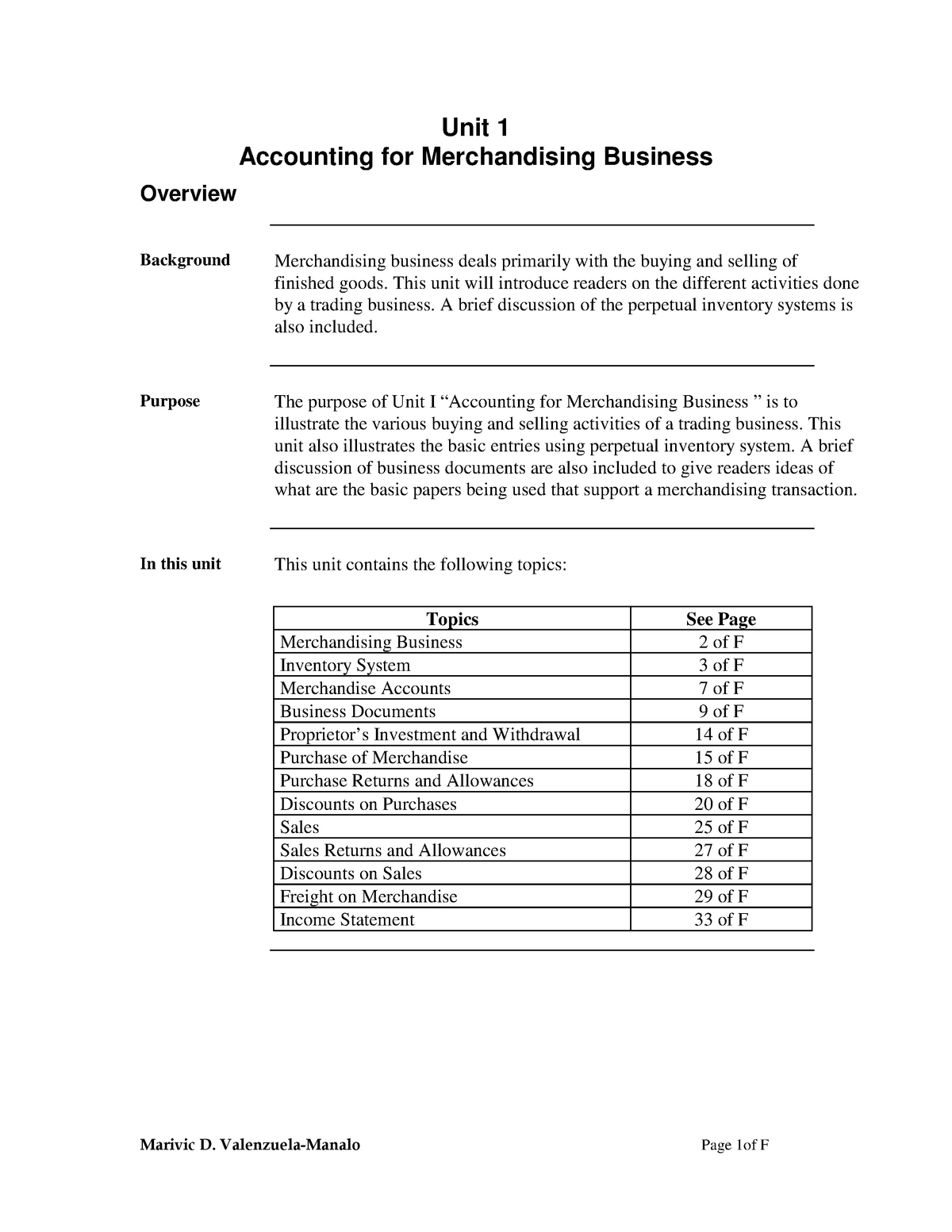

Accounting For Merchandising Business Pdf Unit 1 Accounting For Merchandising Business Overview Studocu

Chapter 5 Accounting For Merchandising Businesses Three Major

Posting Komentar untuk "A Merchandising Business That Usually Has No Beginning Inventory Is When It Has Just Started"