Merchant Account Meaning

A processing freeze occurs when your processor temporarily shuts down your ability to accept card payments. Your customers can make a card payment.

7 Best Saas Billing Systems 2020 Baremetrics

After the payment processor.

Merchant account meaning. The Director of Sales and Marketing said that credit card merchant fees were a significant and increasing cost to the company. Put simply a merchant account is a line of credit account that allows a business to accept card payments from its customers. Merchant Statement means an itemized monthly statement of all charges and credits to the Operating Account.

Businesses need a merchant account to accept major credit cards via a static point-of-sale terminal mobile card reader or through a virtual payment. When you work with a merchant account provider then you receive this account through them and they work with you to get your account set up. These accounts are established by a contract between the business accepting payments and a merchant acquiring bank.

A merchant account is a type of bank account that allows your business to accept debit and credit card payments from customers. What is Merchant Account Underwriting. Home Accounting Dictionary What is a Merchant.

A merchant account is a type of bank account that allows sellers especially in the ecommerce space to electronically accept credit and debit card transactions from customers with the aid of a payment gateway. A merchant account is a business account with an acquiring bank. However the word most commonly applies to wholesalers and people trading from one.

Traditional merchant accounts and payment service providers PSPs. Merchant fees are calculated as a percentage of each credit card sale. A merchant account is a special type of bank account that gives businesses access to funds received from credit and debit card payments.

You dont even have to worry about waiting for your revenues to show up. Processing Freeze Hitting pause on your processing privileges What is it. It simply means that an establishment will receive some type of payment in exchange for any potential risk they decide to cover.

What is a Merchant Account. Your merchant account will front your business the fundsminus feesfrom the credit card transactions you accept before your customers pay off their card issuers. A merchant service provider typically charges a fee to process payments.

Payment service providers allow businesses to accept online payments without setting up a merchant account. 0 0 Advertisement Merchant-account Sentence Examples. A merchant service provider provides businesses with a merchant account and credit card processing services.

Merchant IDs are as important as bank accounts and should be treated as such. Most businesses begin using a merchant account to accept credit card online payments. What Is a Merchant Account.

What Is A Merchant Account. Similar to how a checking account allows you to deposit another persons check into your checking account a merchant account allows you to accept a card payment from a customer. Merchant account providers generally fall into two categories.

Getting a merchant account to handle credit card payments may be your best long-term solution to the problem of getting paid. An ongoing merchant account reserve can be a rolling capped or up-front reserve meaning some portion of your funds are always unavailable. The broader term embraces any legal entity whose main business activity is to buy and sell products.

This option allows businesses to start accepting electronic payments more quickly but it can also be less customizable and. See card not present account. How to create a merchant ID for your business.

A type of bank account that businesses use to accept payment by credit card. Customer accounts A merchant account is a type of bank account that allows a company to accept credit cards. A merchant is a person or firm whose profit is obtained from buying and selling goods to others.

This means that its the merchant service provider that needs to handle the headaches if something goes wrong. The term underwriting is typically used in references to banks or insurance companies or any institution looking to mitigate their risk exposure. A merchant account is the bank account required to accept credit card payments.

The remaining funds are deposited into the businesss merchant account meaning the bank account required to accept payments. A merchant account is similar to a regular bank account in that it stores and collects cashless payments. Customer accounts Merchant fees are money charged by a merchant service to a vendor for processing credit card transactions.

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT MARKED BY BRACKETS HAS BEEN OMITTED AND FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 406 OF THE SECURITIES. You should note that a merchant account isnt the typical bank account as its the basic assumption that poses a lack of certainty. Merchant-account meaning Meanings Sentences An agreement between a credit card processor and a seller that establishes the rules for accepting credit card purchases and transferring funds.

You receive a merchant identification number when you start working with an acquiring bank either directly or more commonly. You open yourself up to vulnerabilities if you widely share this number so dont do it unless you absolutely have to. A merchant account is a business bank account that lets merchants accept debit and credit card payment from customers.

Without this business account which actually works more like a line of credit a merchant cannot accept and process credit and debit card transactions. Merchant accounts give you the funds that you need directly from processed transactions.

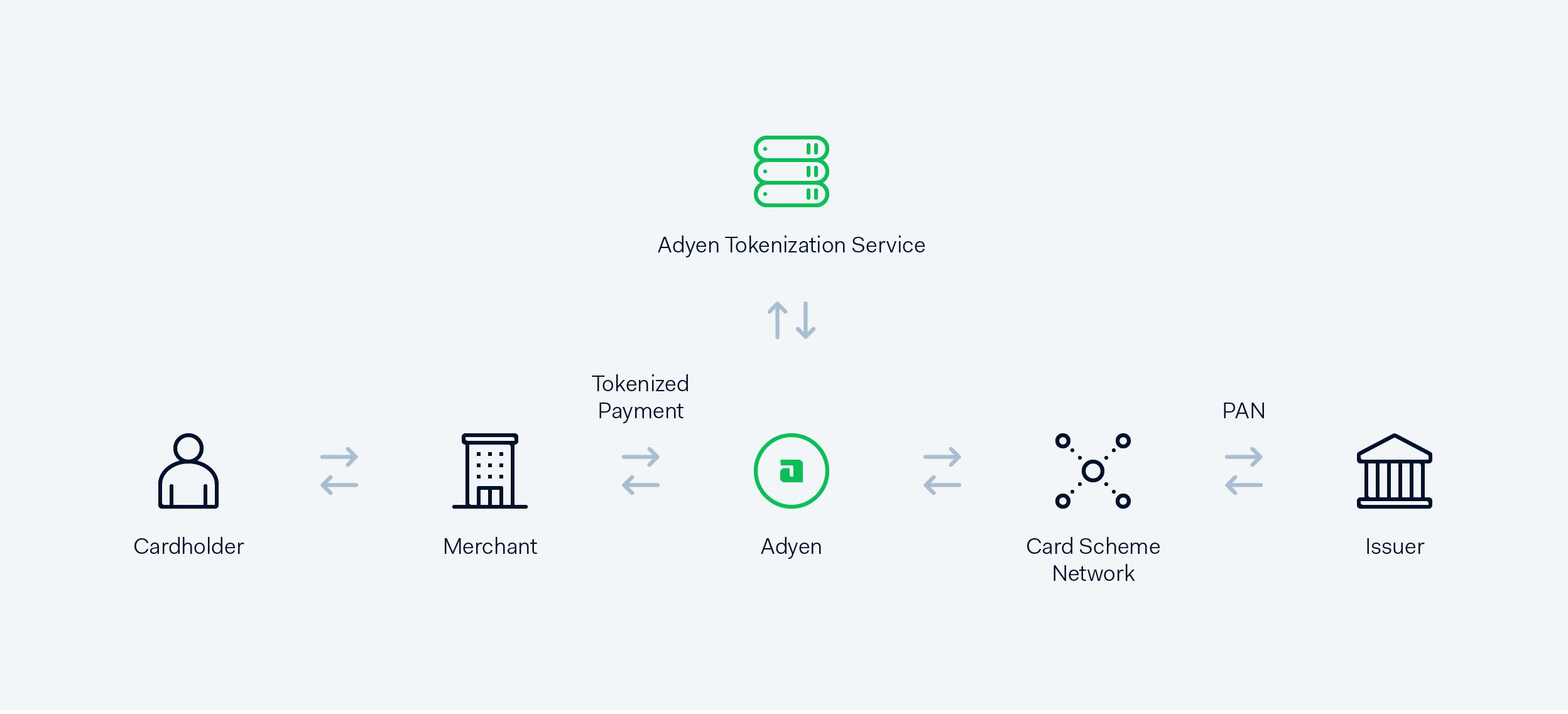

Tokenization Payment Technology Guide Adyen

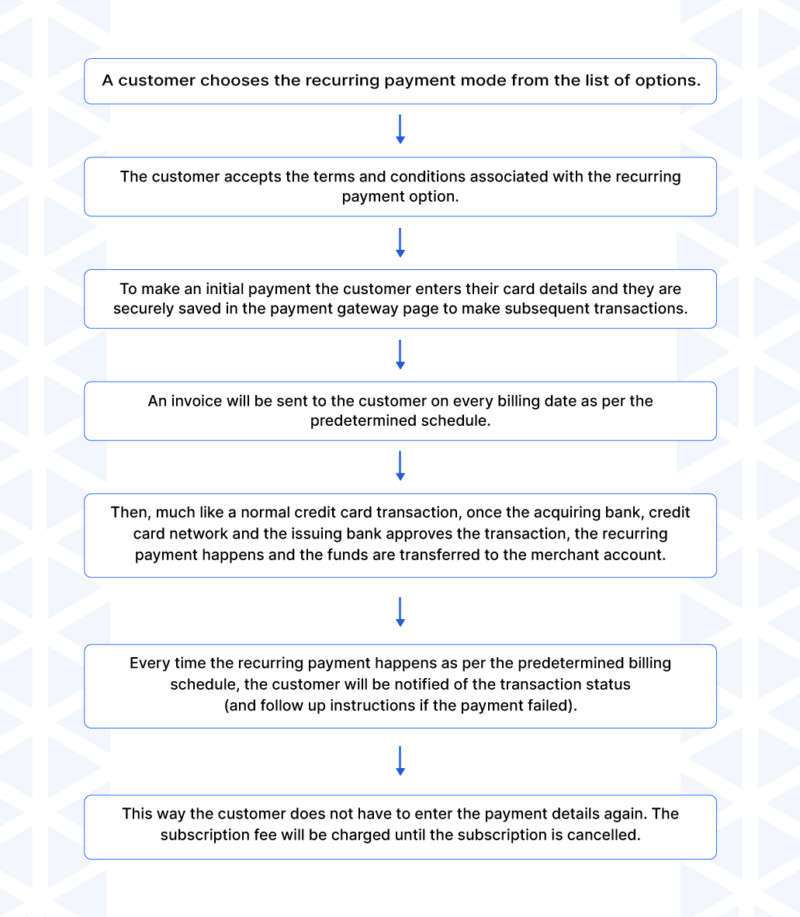

What Is Recurring Payment Definition Types Benefits Essential Business Guides

What Is Google Merchant Center

Posting Komentar untuk "Merchant Account Meaning"